Sup, Zaid here. Welcome to “Money Minutes” the weekly newsletter summarizing market and corporate drama with bad jokes in under 1,000 words. I share the best articles, videos, and tweets of the week. This newsletter is 749 words and should take you 5.8 minutes to read. Please consider subscribing if you haven’t already.

I usually send this newsletter on Sunday. But this week, I decided to switch things up and send it Monday. Let me know what you think. If you prefer to get this on Sunday (or Saturday), please send me a strongly worded reply. Or DM me on Instagram. Now let’s talk markets.

MARKET VIBE CHECK

2023 off to a decent start! Stocks and Crypto both up for the week. Things didn’t look so great Monday through Thursday, but Friday the jobs report came out and it was a double shot espresso for the markets [more on that below].

Now we just need every week in 2023 to do the same.

🔌 Today’s Money Minutes is brought to you by…Fundrise!

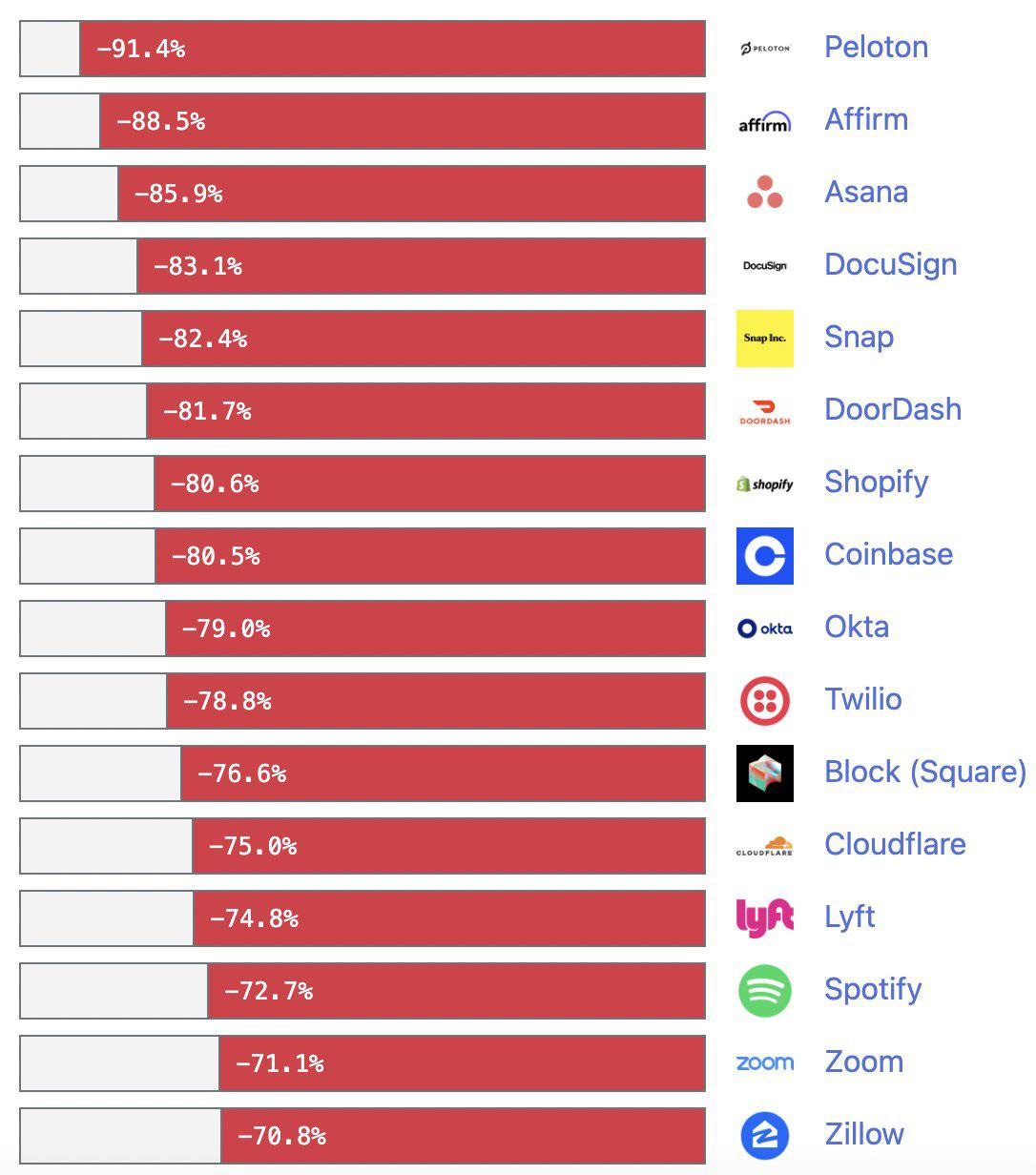

2022 was a BAD YEAR for growth and tech stocks. Check this out:

Unfortunately, there are 9 companies in that graphic that are also in my portfolio. Your boy went heavy on the tech and growth stocks..and got burned.

So in 2023 I’m diversifying. Time to get exposure to some assets that aren’t likely to lose 90% of their value in a year. This year, I’m allocating more of my portfolio to real estate using Fundrise.

Fundrise is a platform that makes it easier for people to get exposure to the private real estate market. They pool the money from investors and purchase cash flowing real estate. Check out this map of all their properties:

If you’ve though about diversifying in 2023, or you’re just sick of being down 80%+ on some of your investments — CHECK OUT FUNDRISE

BUSINESS-Y NEWS YOU SHOULD KNOW

🔥 ECONOMY KEEPS ADDING JOBS: Recession vibes are in the air, but the economy keeps adding jobs! The jobs report came out on Friday (January 6th) and it was strong. 223k jobs added in December. Total of 4.5 million new jobs added in 2022. [Learn More: CNBC, Market Watch: Is a Soft Landing Possible?]

😕 No Fed Pivot in 2023: The Federal Reserve minutes were released on Wednesday (January 4th). JPow and his crew think interest rates are still too high (duh). That means we’re going to see high interest rates for a while. Money Printer staying in storage for 2023. [Learn More: Bloomberg, Yahoo Finance]

😔 More Tech Layoffs: Amazon is laying off 18,000 corporate workers. Salesforce is laying off 8,000. StichFitch is cutting 20% of salaried employees. Sucks to hear people getting laid off. Over the last year, more than 150,000 tech employees have been laid off. With tech stocks getting crushed and high interest rates sticking around, things might get worse.

But why is this happening? Because tech companies hired too many people during COVID. [Learn More: A Short Video From Me, Axios]

🤖 ChatGPT is coming to BING and EXCEL: Microsoft is one of the biggest investors in OpenAI (the company that made ChatGPT). Now Microsoft is planning to incorporate ChatGPT’s magic into Bing and Excel. If Microsoft turns Bing into a ChatGPT-eque search engine, I might not use Google ever again. The Excel + ChatGPT combo might be even better. I never thought Google would have any real threat, but this might be it. [Learn More: The Information [paywall], Great Twitter thread by my buddy Trung]

🍎 Apple’s Metaverse coming soon?: Apple's long-rumored mixed reality headset might finally be coming this spring. Just like every Apple product, it’s going to cost way too much money. The rumored price tag is $3,000! [Learn More: Bloomberg, The Information]

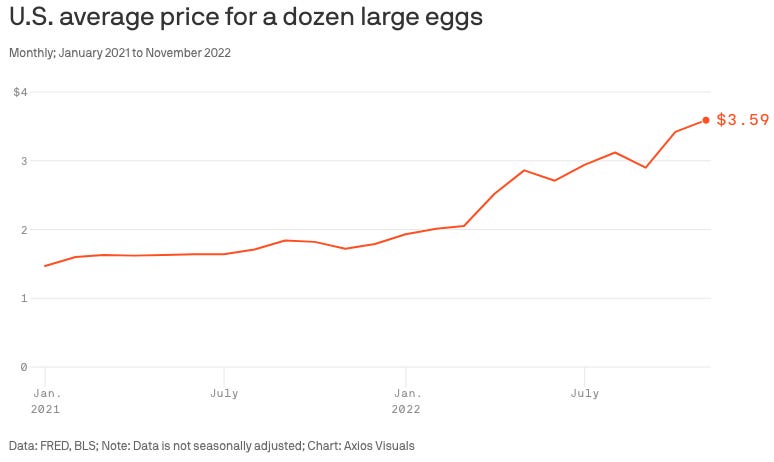

Chart of the Week

Price of eggs have skyrocketed. Thankfully prices might finally start coming down

MEME OF THE WEEK:

Nadella is coming for everyone

And that does it for another newsletter. I’m still experimenting with the format and the content. If you have any suggestions, please let me know!